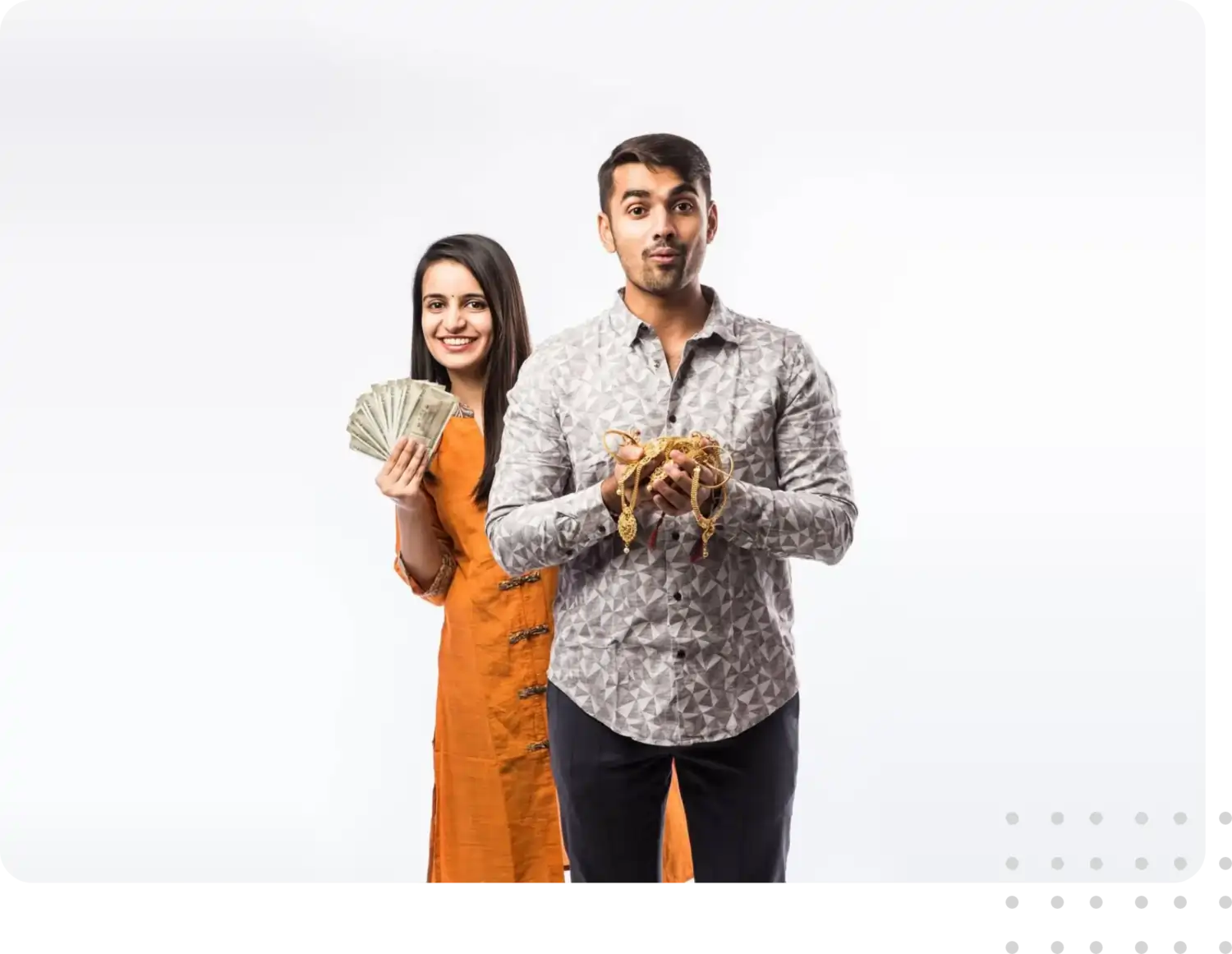

A Gold Loan at NTC Finance is a secured loan that allows you to leverage your gold jewellery as collateral to meet your immediate financial needs. The process is simple - you pledge your gold jewellery, and in return, you receive higher amount, depending on its purity and weight. With competitive interest rates, quick approval, and easy repayment options, a Gold Loan from NTC Finance offers a convenient solution for your financial requirements.

Enquire NowThinking about the required documents for availing a Gold Loan? Check the eligibility criteria based on your employment type and experience easy documentation. You should meet the below mentioned eligibility criteria before applying for a Loan.

| Type | Document |

|---|---|

| ID and Signature Proof | Copy of Voter ID/Driving Licence/Aadhaar Card/PAN Card/Passport |

For additional information regarding gold loan, kindly visit our nearby branch or send us a message.

Locate Nearby Branch